Although devastating frost doesn’t occur each year, it will occur often. Is the loss of crops due to frost infrequent? Again, the answer is no. Going oranges depends on the environment. Is this an unusual event? The answer is no. Is this considered an extraordinary event? Going by the extraordinary item definition, it must meet both criteria. Then the weather prematurely gets cold and frosts half of the orchard.

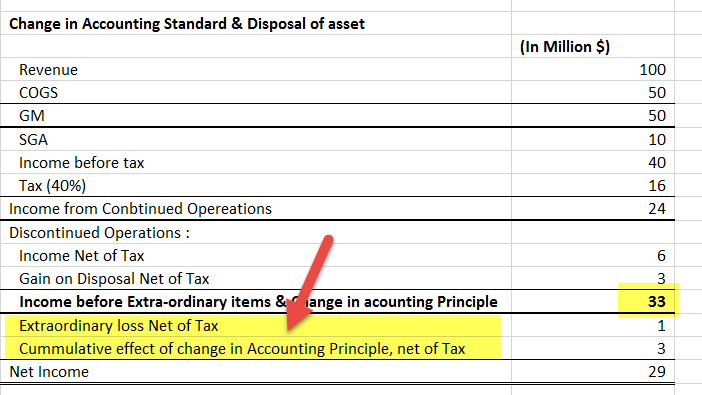

Management was also required to report and disclose how these items affected the earnings per share calculation.Īssume Paul’s Orange Grove, located in Florida, is gearing up for a great harvest. These events were also required to be disclosed in the company’s financial statement footnotes listing the nature of the events, the extent of the gain or loss, and the income tax ramifications. At the same time, they can see the effects of the extraordinary events on the bottom line. The net operating activities reported are pure, so investors and creditors can see how the core business activities are doing. Thus, reporting it in a separate section of the income statement makes sense. This decree makes sense because creditors and investors want to see if something affecting the income statement had nothing to do with the business operations.įor example, if the company reported a huge loss from a natural disaster in its income from operations, the net operating income would be artificially low even though its operations might be higher than last year. If a deal met both of these criteria, meaning it rarely occurred and was outside the scope of normal business operations, management was required to report these events separately in a different section of the income statement. Originally, FASB required that all business transactions be analyzed for two main criteria: unusualness and infrequency. Although these requirements will not be in place in the future, I think it’s still important to discuss the old way of treating them verses the new standards. In 2015, however, FASB updated its income statement standard number 2015-01 to remove the separate reporting requirements of these items. Historically FASB has required companies to report these transactions separately on the income statement. They also are not predictable or occur on a regular basis. To put it differently, all these are trades that are unnatural and don’t relate to the principle business activities. Extraordinary items in bookkeeping are revenue announcement events that are both unusual and rare.

0 kommentar(er)

0 kommentar(er)